The Absa Manua isle can be found throughout the western region from the area of Vera Juan, around Samaras. Title Absa arises from the Tahiti language this means ‘to stand out.’ Vera Juan may label of the cash of Vanuatu plus the premier area the area. The Absa Manua finance is the just debt your ABSA provides ever changed in Vanuatu.

dial direct personal loans This debt is perfect for an individual investments in homes and it’s not a company loan. Because of this, the attention costs are typically above ordinary. If however it is possible to make the month-to-month monthly payments consequently this can be a very good package requirements. You’d pay out a confined payment per month to your ABSA in addition they would in turn utilize the money order your belongings. They are certainly not allowed to allow property out for any reason because they need the money to be charged for a person back.

Ways this is effective is you would very first request the mortgage. If perhaps you were approved next an appraisal is carried out on your property to discover the importance. Following this the mortgage is then authorized. The continues from the money happen to be subsequently transferred straight away to your to devote.

However, there are actually certain problems that you would have to encounter before being qualified when it comes to money. These types of is you should really be a resident of Vanuatu. Be sure to demonstrate proof of regular job and the annual income. You will additionally wanted evidence that you’re a long-lasting homeowner of Vanuatu. Through the most detrimental case circumstances, you may come refused if you have excellent charge factors.

If you do not have any variety of stable work your odds of being acknowledged for that money are extremely lean. To increase the chances of you getting accepted the ABSA may wish to observe that you could be worth it the mortgage. For them to make this happen it is advisable to persuade them that the revenue happens to be regular. The simplest way to accomplish this is simply by proving your own monthly expenditures and perchance evidence of additional lending products that you have put aside.

By demonstrating every one of those you’ll probably be accepted for any debt. But it is best to only put on ABSA for those who have had experience of debt relief prior to now. You will need to keep in mind that this funding is made to assist you in getting out of debt instead of to give you into credit once again. Because of this, creating a history of loans factors will badly influence the job.

Yet another thing that ABSA will discuss is whether or not it’s possible to repay the mortgage in good time. You are likely to normally have a grace time period of about two months after your application to increase your time and energy to repay the loan. As soon as the two-month years possess terminated then you will really need to begin to make money. Even though this is often stressful to the guy getting the loan, it is critical to bear in mind this is a thing that should be carried out in order to ensure that your homes.

The ABSA may even choose measurements the mortgage basically acquire. You may be eligible for a larger loan than one that a person with your same income and assets may qualify for. It is essential to see the terms and conditions of ABSA money that you are looking at applying for. Together with level that you could use while the interest rate you will be most likely to shell out, there can be more costs added onto the price of the mortgage. For instance, there may be an annual maintenance price put onto the loan that you may have to pay out annually. You need to check the conditions and terms and also the fine print associated with any debt that you will be contemplating removing in order to avoid any unexpected situations down the road.

NGÓI NAKAMURA SÓNG NHỎ

NGÓI NAKAMURA SÓNG NHỎ NGÓI NAKAMURA SÓNG LỚN

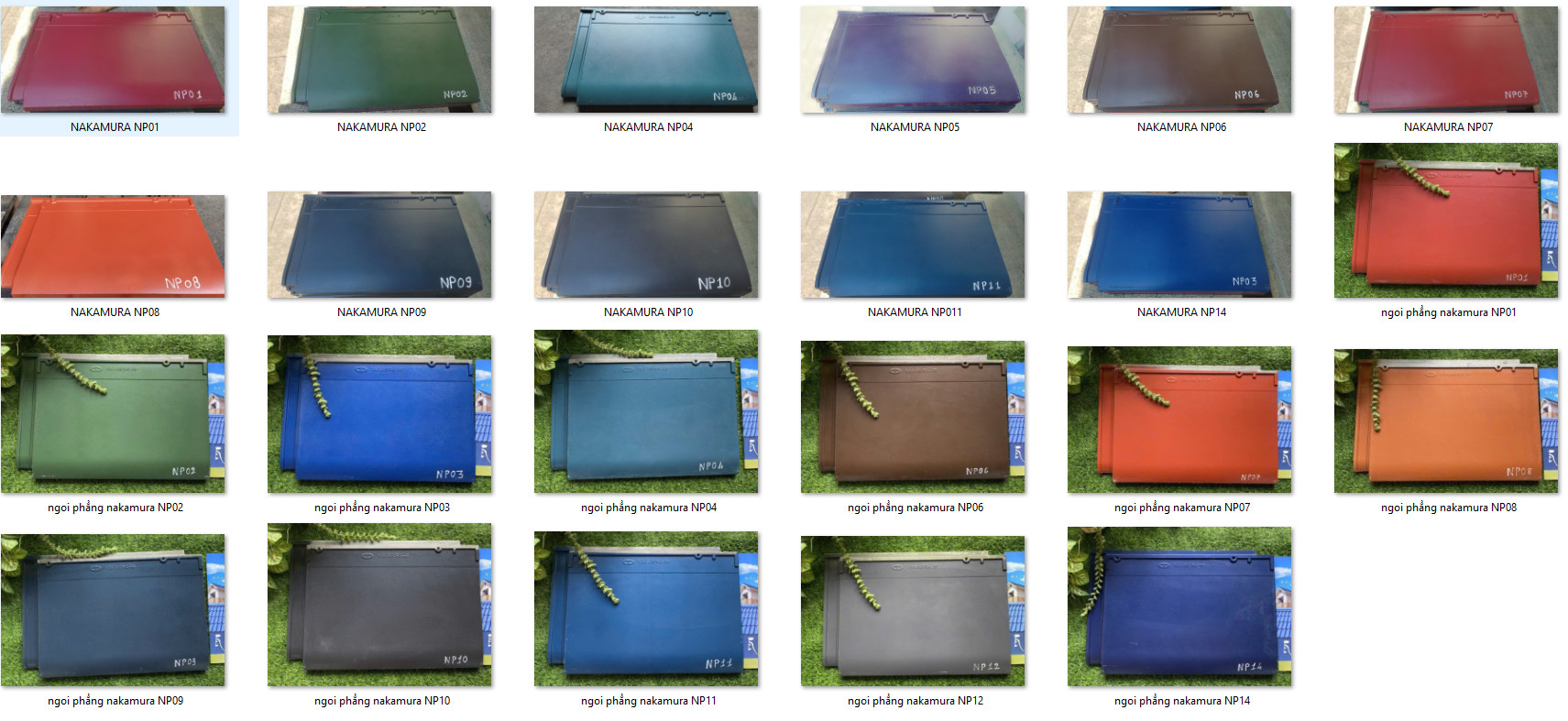

NGÓI NAKAMURA SÓNG LỚN NGÓI PHẲNG NAKAMURA

NGÓI PHẲNG NAKAMURA