Direct Axis signature loans is offered by R5000 to R200000 and includes a flexible payment routine all the way to one full year. The monthly payment phrase may vary dependant upon the price and ways in which a great deal an individual funding. Occasionally in your life there are many reasons for you to take out a personal money. You need financial to get started with a new company or buy a fresh wheels, or perhaps you may need money to pay for a vacation or maybe be worth it some debt because of your mortgage.

These loans are extremely an easy task to find, and do not require any credit investigations. Actually individuals with a terrible overall credit score may still implement and become authorized for those debts. When you yourself have a beneficial credit score then this loan providers will favor that you receive strong axis unsecured loans instead of remove any kind of funds from somewhere else. As the numbers happens to be more compact, you’ll receive reduced focus throughout the phase from the funding, this means truly economical over time to acquire this amount and payback they quickly.

The best aspects of drive axis signature loans would be that they have the ability to offer combination personal loans too. When you have pilfered income to consolidate your debts or simply dial direct personal loans just to decrease the quantity of debts that you have undoubtedly should think about receiving this finance. The regards to consolidation usually are really great and can mean that your own month-to-month settlements are lower that may help you be paying off your financial troubles more rapidly. This can help to ensure you can preserve up with your repayments and you you should not put on loans once again.

Quite possibly the most essential issues when looking for the direct axis personal bank loan measure is that you simply ensure that your monthly revenue up-to-date. When you look at the almost all instances you could only pay the mortgage down the moment the payment you will get is becoming offered. By keeping your income up-to-date you’ll make sure that your amount borrowed will not be moved by rising prices. While combining your debts, it is really quite an easy task to fall under personal debt once more should your month-to-month profits is reduced.

One of the recommended ways in which you can receive lead lending products with less than perfect credit is get hold of your lender and ask them should they supply such type of money. Normally they do get specific money programming which can be targeted at those people who have a negative credit ranking or an unhealthy credit score. You can use your financial institution’s strong application for the loan version to find out more about these solutions. You may be eligible to apply for the SSS financing immediately throughout your bank. When you find yourself doing all your investigation into banking institutions that include drive lending products for people with a low credit score, its also wise to be sure that you determine their own plans along with their borrowing charges.

When you use the financial’s immediate debt form you could be need some information. That will likely feature your name, target, and a few more equipment. After filling out your very own details the loan calculator will offer an estimate of what kind of money you may choose to qualify for. The calculator will even demonstrate whether or not it will be easier to achieve the funds you are seeking through drive loan out of your bank.

In order to get good rate on the unsecured loans for people who have below-average credit you have got to consider carefully your circumstance completely. You need to be aware of the absolute valuation of your automobile, including virtually any assets you own. You will need to know what your earnings is definitely and regardless of whether you will be making plenty of funds each and every month to help the loan each and every month. If you find yourself struggle to indicate you have got a gentle profits or that you may have many income to get upon auto then you might often be fortunate taking out your own money from the bank.

As with any integration loans it cannot be overemphasized you take a look at terms and conditions from the loan very carefully prior to deciding to agree to take it out. Something that lead axis personal loans do is definitely integrate a computerized stay term, which means the borrowed funds is going to be ended from starting in the event the creditor requires they. This is exactly a life threatening safeguard and something that you should be familiar with. It is actually around on your own protection.

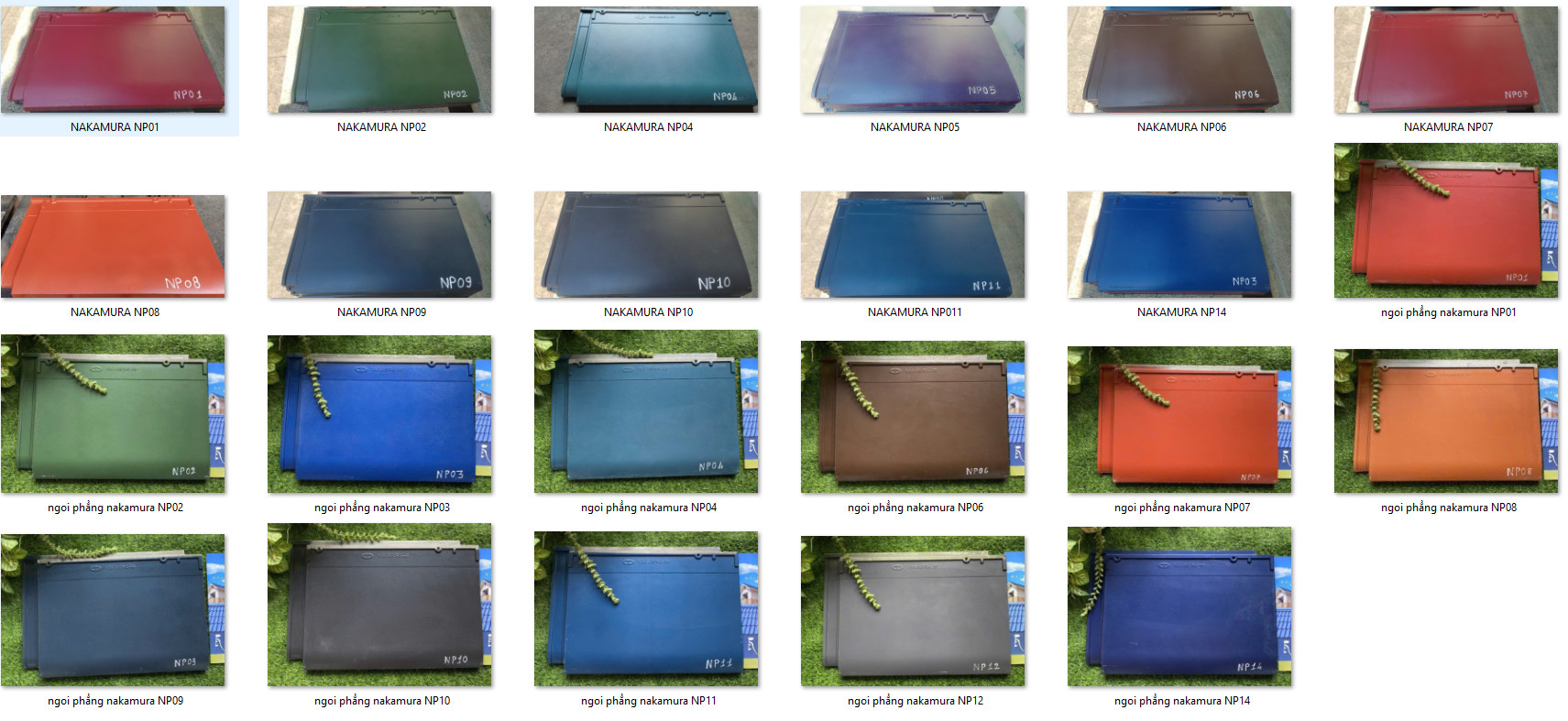

NGÓI NAKAMURA SÓNG NHỎ

NGÓI NAKAMURA SÓNG NHỎ NGÓI NAKAMURA SÓNG LỚN

NGÓI NAKAMURA SÓNG LỚN NGÓI PHẲNG NAKAMURA

NGÓI PHẲNG NAKAMURA