Furthermore, accounts receivable are classified as current assets, because the account balance is expected from the debtor in one year or less. Other current assets on a company’s books might include cash and cash equivalents, inventory, and readily marketable securities. Companies record accounts receivable constructing the effective tax rate reconciliation and income tax provision disclosure as assets on their balance sheets because the customer has a legal obligation to pay the debt and the company has a reasonable expectation of collecting it. They are considered liquid assets because they can be used as collateral to secure a loan to help the company meet its short-term obligations. Accounts receivable (AR) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet. Accounts receivable is listed on the company’s balance sheet as a current asset.

For example, the company loans an employee money for a travel advance or a company borrows money from another company. To measure income and to disclose the amount of cash expected to be realized from non-trade receivables, it is necessary to determine their collectibility. They are almost always classified as current because their normal collection period is part of, and therefore less than, the operating cycle.

For example, the company loans an employee money for a travel advance or a company borrows money from another company. Other receivables that arise from loans to outsiders, employees, or stockholders should be shown separately from trade receivables. An everyday example of accounts receivable would be an electric company that bills its clients after the clients receive and consume the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills. Company B now owes Company A money, so it lists the invoice in its accounts payable column.

Why You Can Trust Finance Strategists

In any event, any contingent liability arising from discounted notes treated as sales should be disclosed in the notes to the financial statements. In the current asset section of its 31 January 2020 balance sheet, total receivables are listed net at $3,673 million. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services from another party.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. That is to say, the firm is unlikely to have sufficient historical knowledge to apply a percentage in the same way as is done for trade receivables.

Which of these is most important for your financial advisor to have?

- Net receivables is an accounting term for a company’s accounts receivable minus any receivables it has reason to believe it will never collect.

- Trade discounts are reductions below a list price; they are used to establish a final price for the transaction.

- This reduced price is the starting point for the accounting treatment, and the list price is not recorded by either party.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Accounting theorists have long recognized that lending cash at a low interest rate causes firms to lose income. In this situation, stockholders may want to know that the corporate funds are being loaned to officers. Trade discounts are reductions below a list price; they are used to establish a final price for the transaction.

An important factor to be considered in establishing the initially recorded amount is the discount offered to the customer. In the event that separate classification is not helpful, they can be combined into a single other receivables item. When receivables are discounted with recourse, the issue arises as to whether the transfer should be treated as a sale or as collateral for a loan. If the receivable arises from a loan to a stockholder or employee and there is no definite due date, it should be considered noncurrent. The risk can be tolerated if it produces income through finance charges or through increased sales.

Trade Receivables

Companies will establish a subsidiary (think of as secondary or detail) ledger for accounts receivable to keep up with what is owed by each customer. The total amount owed according to the subsidiary ledger should always match the balance in the accounts receivable account. A note (also called a promissory note) is an unconditional written promise by a borrower to pay a definite sum of money to the lender (payee) on demand or on a specific date and usually include a required interest amount. Companies also have non-trade note receivables if they loan money to non-customers. Companies will establish a subsidiary (think of as secondary or detail) ledger for accounts receivable to keep up with what is owed by each customer.

You should periodically evaluate find every deduction with turbotax self 2020 the individual items recorded in the non trade receivables account to see if the company is still likely to receive full payment. If not, reduce the amount in the account to the level you expect to receive, and charge the difference to expense in the period in which you make this determination. This evaluation should be conducted as part of the period-end closing process. Non trade receivables are amounts due for payment to an entity other than its normal customer invoices for merchandise shipped or services performed. Examples of non trade receivables are amounts owed to a company by its employees for loans or wage advances, tax refunds owed to it by taxing authorities, or insurance claims owed to it by an insurance company.

Accounts receivable represents money that a business is owed by its clients, often in the form of unpaid invoices. “Receivable” refers to fact that the business has earned the money because it has delivered a product or service but is, at that point in time, still waiting to receive the client’s payment. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. This example shows actual disclosures of non-trade receivables from Pitney-Bowes, Inc. and Rockwell International Corporation. In general, firms write off non-trade receivables in the year in which they are known to be uncollectible instead of providing for the loss in an earlier period.

If the realistic rate for January 2021 is 11%, then this person has received a substantial benefit and the company has incurred a substantial cost. However, they require special disclosure because of the fact that the loan is a non-arm’s-length transaction between related parties. Receivable are all amounts OWED to a company that are expected to be settled in cash. Additionally, accountants disclose the net amount of cash that is expected to be collected, as well as any collateral agreements. Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Notes have a specific definition under GAAP but for the most part, this will be an IOU from one company to another that may or may not get paid off in time. Notes are a little more complicated and they follow a different accounting treatment. To help financial statement users make other decisions, GAAP call for other disclosures regarding receivables.

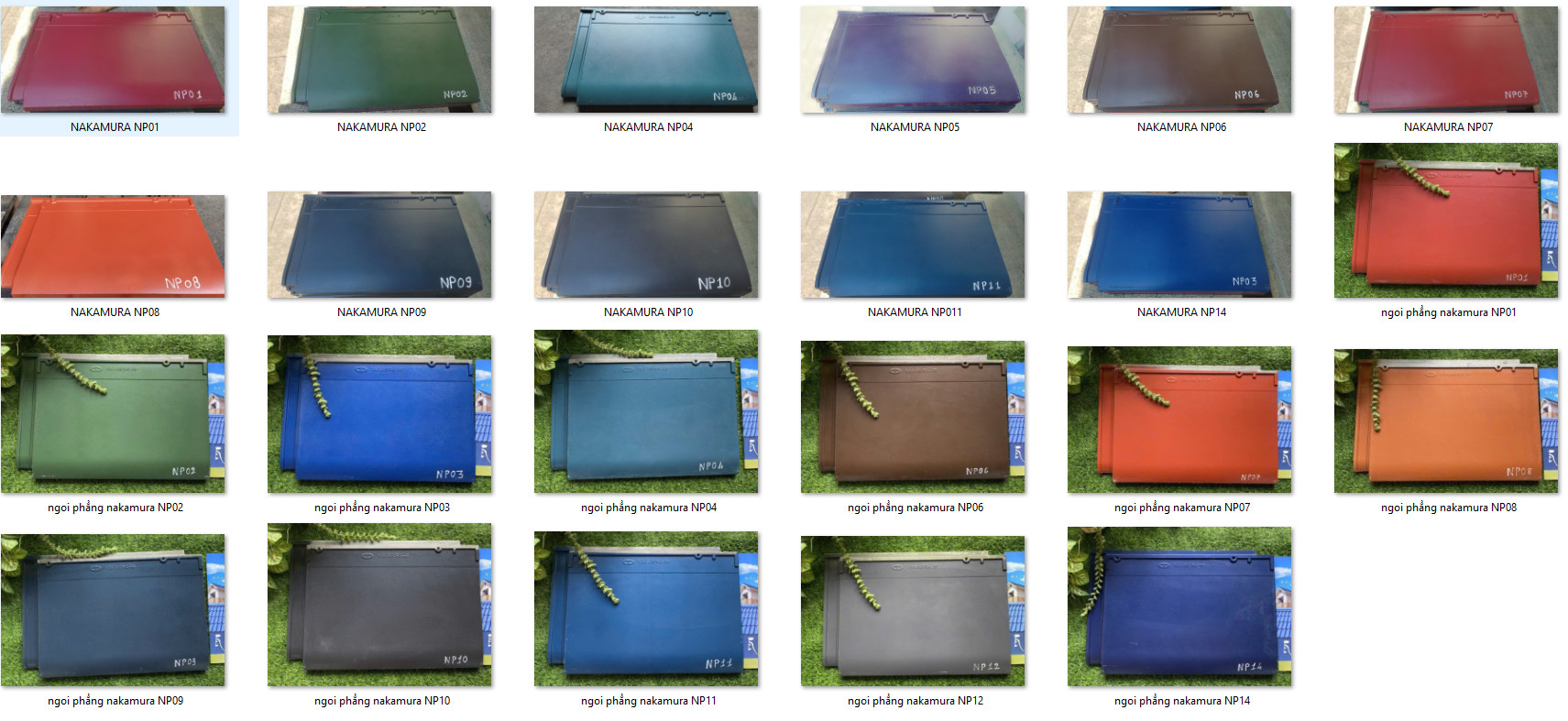

NGÓI NAKAMURA SÓNG NHỎ

NGÓI NAKAMURA SÓNG NHỎ NGÓI NAKAMURA SÓNG LỚN

NGÓI NAKAMURA SÓNG LỚN NGÓI PHẲNG NAKAMURA

NGÓI PHẲNG NAKAMURA