ICT High Low Resistance Liquidity Runs HRLR vs LRLR by Baguera

Content

- Eight examples of mergers and acquisitions in the automotive industry

- Buy-Side vs. Sell-Side Analysts: What’s the Difference?

- How can traders spot entry points based on Buy Side Liquidity Forex?

- Inducement Strategies for Market Participants

- The Role of Buy Side Liquidity Providers

- Master Liquidity in Forex Trading with 3 Step Guide

- Buy-Side vs. Sell-Side in the Financial Industry

- Buy-side vs sell-side: Key differences

They then recommend to portfolio managers whether to buy, hold, or sell specific securities. ICT is based on market structure analysis, liquidity areas, trading volumes, and other variables to determine the best trade entries. The ultimate buyside vs sellside liquidity goal of ICT traders is to emulate the behaviour of institutional investors, also known as “smart money” players, in order to achieve consistent and profitable results. When trading reversals, traders should look for price actions that confirm a potential reversal around buy side or sell side liquidity levels.

Eight examples of mergers and acquisitions in the automotive industry

In both cases, market structure shifts tend to occur on the heels of a displacement. ICT is an approach that strives to decipher the intricate dynamics of the markets, as well as replicate the behaviour of astute institutional investors. The integration and application of ICT trading concepts can deliver a substantial boost to a trader’s performance. The Inner Circle Trader (ICT) methodology offers a distinctive perspective on the markets, attracting numerous traders with its unconventional approach to price action in foreign exchange, crypto, https://www.xcritical.com/ and other markets. One of the key components of this philosophy is the concept of buy and sell side liquidity.

Buy-Side vs. Sell-Side Analysts: What’s the Difference?

For instance, a fund management or asset management firm might run a fund or set of funds. A buy-side portfolio manager might learn of a new tech product that sounds promising. After doing research on the company and determining whether it was a wise investment, the PM might purchase shares of that company. While we are talking about M&A deals, it’s worth pointing out that all types of financial transactions have a buy side and sell side. Buy-side markets focus on the purchase of stock shares, bonds and other investments. The investment banking industry is a complicated ecosystem which is a collective body of interdependent entities with unique functions.

How can traders spot entry points based on Buy Side Liquidity Forex?

Sellers’ motivations come down to finding the right balance between price, terms, timing, and fit. For example, one seller’s exit strategy might be to stay on with the company and keep a portion of ownership, while another seller might sell the company entirely and ride off into the sunset. These two sides together make up the main activities in the financial market. The cloud-based software company Coupa Software was purchased in an $8 billion all cash deal. Space infrastructure company Maxar was purchased in another all cash deal, with shares going for 130% over asking prices.

Inducement Strategies for Market Participants

Whereas the buy side aims to get the best value from investments in order to bring in greater returns for clients, the sell side aims to help clients raise capital through the sale of securities. Sell siders keep close track of the performance of specific companies they track, keep track of stocks, and model and project future financial performance and trends. They come up with research recommendations and target prices and sell ideas to clients. For example, if an M&A advisor works on both the sell-side and buy-side of M&A, it is possible that mixed buy-side and sell-side relationships could create conflicts of interest. In short, they may not drive a competitive process ending in the best outcome for the seller.

The Role of Buy Side Liquidity Providers

Recognizing supply and demand dynamics and acknowledging the influence of institutional investors enhances traders’ confidence, particularly in hard-to-read markets. They strategically leverage the collected buy orders at these highs to drive prices upward. They create good conditions for buying and selling assets, making the most of price changes to get more money. These include stop losses, retail investors, price changes, and the main roles of buyers and sellers in the market.

Master Liquidity in Forex Trading with 3 Step Guide

By understanding each, you’ll gain a clearer picture of how these analysts help shape the views of investors. Displacement, in short, is a very powerful move in price action resulting in strong selling or buying pressure. Generally speaking, displacement will appear as a single or a group of candles that are all positioned in the same direction. These candles typically have large real bodies and very short wicks, suggesting very little disagreement between buyers and sellers. “Smart money” players understand the nature of this concept and commonly will accumulate or distribute positions near levels where many stops reside.

Fair Value Gaps are created within this displacement and are defined as instances in which there are inefficiencies, or imbalances, in the market. These imbalances are visualized on the chart by a three-candle sequence containing one large middle candle whose bordering candles’ upper and lower wicks do not overlap. ICT can be profitable for those who understand the markets and can use the methods involved wisely. However, like any strategy, there is always a risk involved, and profits cannot be guaranteed. Alexander Shishkanov has several years of experience in the crypto and fintech industry and is passionate about exploring blockchain technology.

- Their primary responsibility is to assess companies and conduct equity research, evaluating factors like future earnings potential and other investment metrics.

- Consider learning about our financial resources to further enhance your understanding.

- When central banks reduce liquidity during economic recovery, these bubbles burst, causing market fluctuation and significant investment losses, maintaining doubt.

- If there isn’t enough on the balance sheet to finance an all cash deal, they can take out a loan, issue bonds, or tap other assets to bridge the gap.

- While both are integral parts of the financial ecosystem, they have distinct roles, functions, and perspectives.

- For investors, understanding the roles and incentives of both sides is crucial.

- One of the key components of this philosophy is the concept of buy and sell side liquidity.

Buy-side vs sell-side: Key differences

The buy-side vs. sell-side distinction in M&A refers to firms that sell or purchase products like stocks and bonds. For those on the sell-side, an analyst’s job is to entice investors to purchase these products, while those on the buy-side utilize capital to procure these assets for sale. Buy-Side Analysts Focus on creating detailed, long-term investment strategies for their firm’s portfolio. Their analysis tends to be more in-depth and proprietary, aimed at achieving high returns over time. Accuracy is critical, as their firm directly acts on their recommendations, impacting the overall performance of the managed funds. The buy-side of the capital markets consists of professionals and investors with funds available to purchase securities.

Sell-side firms may face pressures to generate investment banking or trading revenue, which could influence their research or recommendations. Buy-side firms must exercise due diligence and rely on multiple sources of information to make informed investment decisions. Experienced market participants, including institutional investors, may strategically adjust prices to access liquidity when necessary.

For instance, an asset management firm has a fund that invests in alternative energy companies. The portfolio manager of the firm seeks opportunities to invest money in offers that seem the most attractive and beneficial. Investment banks tend to dominate the sell side of the financial markets; they underwrite stock issuances, sell to institutions and individuals and take proprietary positions in securities.

Professionals on the buy side typically work in portfolio management, wealth management, private equity, hedge funds and sometimes venture capital. Buy-side companies work to identify and buy underpriced, undervalued, or high-potential securities for clients in order to make the highest profit on their trades. Understanding the intricacies of the hierarchy among the buy side and sell side investment banking is vital for industry practitioners and investors. On the buy side, it emphasizes long-term investment plans and asset management. However, on the other hand, the sell side is very efficient in transactions and advisory services.

This ends in a sudden surge or decline in price, relying on the course of the breakout. The theoretical underpinnings of liquidity tackle practical significance in the context of private fairness transactions. For occasion, let’s think about a scenario the place you’re looking to acquire a company with a low present ratio. This liquidity crunch could signal difficulties in assembly short-term obligations, prompting you to reassess your acquisition technique or seek avenues forperformance enchancment pre-acquisition. Though the ideas may be a bit international to merchants who’re used to a extra conventional technical evaluation method, there is a cause that the ICT methodology has turn out to be so well-liked. At their core, markets are constructed off of worth motion and trend, and necessary levels can play a big position in the place and why the worth reverses.

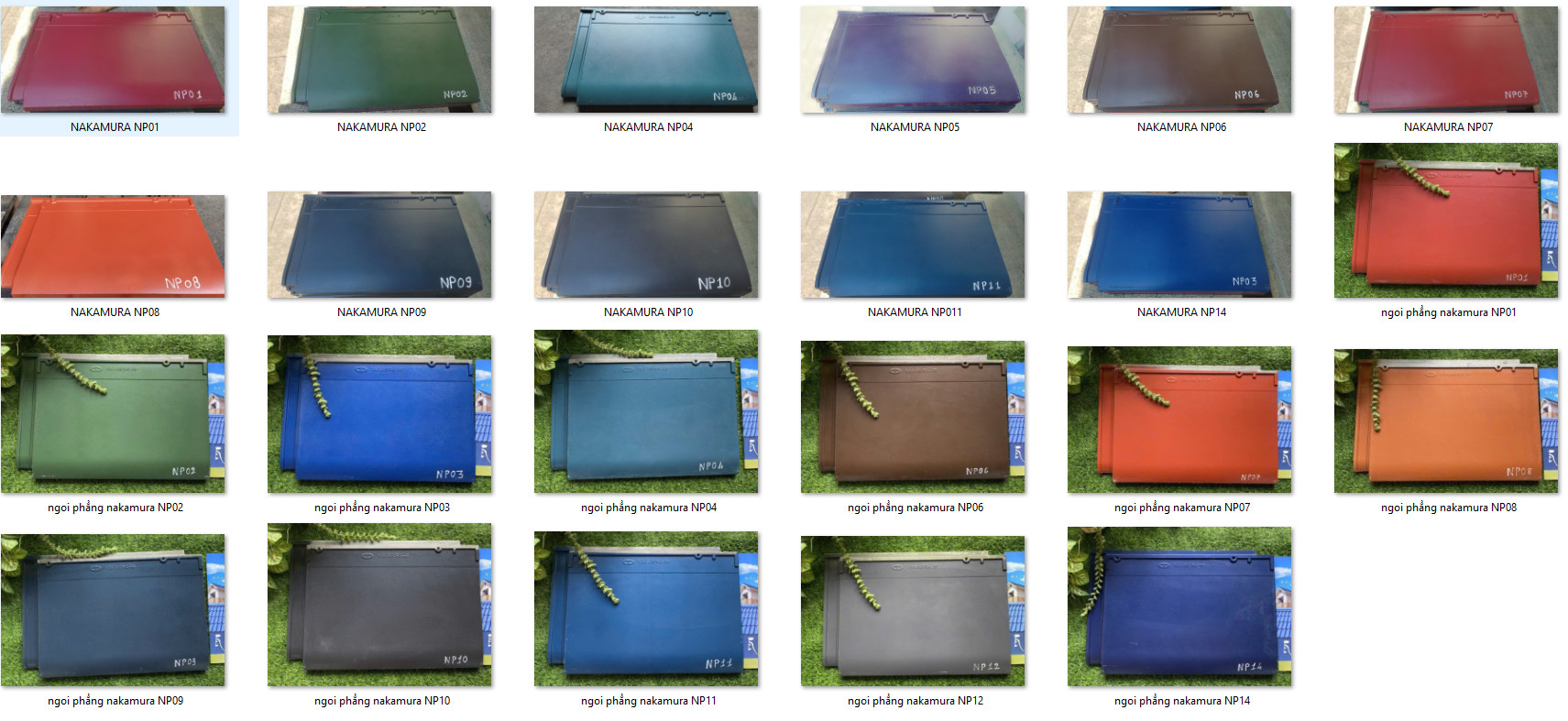

NGÓI NAKAMURA SÓNG NHỎ

NGÓI NAKAMURA SÓNG NHỎ NGÓI NAKAMURA SÓNG LỚN

NGÓI NAKAMURA SÓNG LỚN NGÓI PHẲNG NAKAMURA

NGÓI PHẲNG NAKAMURA