Today’s Death Cross Stocks

The third moving average is the 100-day MA, a medium-term MA between the other two moving averages. For a double death cross to appear, a short-period moving average (50-day MA) will have to cross below both long-period moving averages (100-day MA and 200-day MA). But its historical track record suggests the death cross is rather a coincident indicator of market weakness rather than a leading one.

How to Buy Target Stock Invest in TGT

Options and futures are complex instruments which come with a high risk of losing money rapidly due to leverage. Before you invest, you should consider whether you understand how options and futures work, the risks of trading these instruments and whether you can afford to lose more than your original investment. The MA is the calculated average of any subset of numbers, daily chart trading strategies using a technique to get an overall idea of the trends in a data set. Once you understand the MA formula, you can start to calculate any subsets to get your MA. It can be calculated for any period of time, making it extremely useful to forecast both long and short-term trends. Investing and trading are complex activities that require a good understanding of financial markets.

How to calculate moving average

For there to be a death cross, both the long term and short term moving averages must be falling. Since the death cross is a reversal signal, the price is also required to come from a bullish long term trend. Like two sides of the same coin, the death cross is the bearish version of the golden cross.

Moving average trading strategies

The implication is that market Trendline trading strategy sentiment is deteriorating more rapidly in the short term than in the long term, which suggests a downward trend. One of the primary bearish signals in stock trends is when the short-term moving average crosses below the long-term moving average. A death cross example would be when a 50-day moving average (short-term) crosses below the 200-day moving average (long-term), indicating potential forthcoming bearishness in the stock. The death cross occurs when a short-term moving average crosses below a long-term moving average, signaling potential bearishness. Conversely, the golden cross happens when the short-term moving average crosses above the long-term one, indicating potential bullishness.

Use these ten stocks to generate a safe and reliable source of investment income. Another S&P 500 death cross took place in March 2020 during the initial COVID-19 panic, and the S&P 500 went on to gain just over 50% in the next year. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage.

While indicators like the Death Cross can provide valuable insights, they are not foolproof. Conventionally, the most common combination includes how to become a successful java developer the 50-day moving average (short-term) crossing below the 200-day moving average (long-term). Before a death cross, the long term moving average often acts as a resistance level. However, once the death cross has taken place, the moving average instead becomes a resistance level. In other words, the market will find it difficult to get above the moving average.

In financial analysis, the Death Cross refers to a specific pattern on a stock chart. This pattern arises when a short-term moving average of a security’s price crosses below its long-term moving average. While a bearish signal, the pattern is often a better indication of a short-term market slump or price correction than the emergence of a bear market or recession.

The bearish form comes when the 50-day SMA crosses below the 200-day SMA, providing a sell signal. Conversely, a bullish signal comes where the 50-day SMA breaks above the 200-day SMA. A Death Cross is a technical trading signal that occurs when a short-term moving average crosses below a long-term falling moving average. This crossover is interpreted by investors and traders as a bearish indication of a potential shift from bullish to bearish market conditions. It signifies a weakening trend momentum and is often used as a sell signal by market participants. The death cross pattern often occurs after the trend has already shifted from bullish to bearish, i.e., it confirms the occurrence of a trend reversal; it doesn’t predict it.

The appearance of a Death Cross might prompt investors to sell their holdings to avoid potential losses from a bearish market. However, the timing of these decisions is crucial, considering the lagging nature of this indicator. Similarly, the presence of other technical indicators, like volume spikes or other bearish patterns, can either reinforce or contradict the Death Cross signal. It is the shorter-term moving average that is used to gauge the recent trend of a security. Ultimately, crossovers can merely tell us what we already know, that momentum has shifted and should not be utilized for market timing or predictive purposes. In short, while all big sell-offs in the stock market start with a death cross, not all of them lead to a significant decline in the market.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- When trading a death cross or even a golden cross, a momentum indicator like the relative strength index (RSI) or stochastic can fine-tune your entries and exits.

- Golden crosses and death crosses are market signals observed by technical analysts.

- SPY would then fall back to $431.73 and try to hold between the daily 50-period moving average and 200-period moving average between $431 to $437.

- Additionally, the S&P 500 formed a death cross in December 2007, just before the global economic meltdown, and in 1929 before the Wall Street crash that led to the Great Depression.

- The technical interpretation of a death cross is that the short-term trend and the long-term trend have shifted.

For other investors, these provide a low-cost entry point to the market that yields a significant return in time. The indicator gets its name from the alleged strength of the pattern as a bearish indication. In short, traders who believe in the pattern’s reliability say that a security is “dead” once this bearish moving average crossover occurs. The use of statistical analysis to make trading decisions is the core of technical analysis. This strategy utilises the Bollinger band tool with the 20-day SMA placed within the middle of the bands.

Margin debt grew, and when stock prices began declining, margin calls forced many investors to sell, which exacerbated the economic downturn. The first phase involves the existing uptrend of a security, when it begins to reach its peak as buying momentum tapers off. This is interpreted by analysts and traders as signaling a definitive upward turn in a market. The EMA is calculated by placing greater weight on the most recent data points.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Explore the range of markets you can trade – and learn how they work – with IG Academy’s free ’introducing the financial markets’ course. The SMA formula is calculated by taking the average closing price of a security over any period desired. To calculate a moving average formula, the total closing price is divided by the number of periods. The moving average is very similar to finding the ‘middling’ value of a set of numbers, the difference being that the average is calculated several times for several subsets of data.

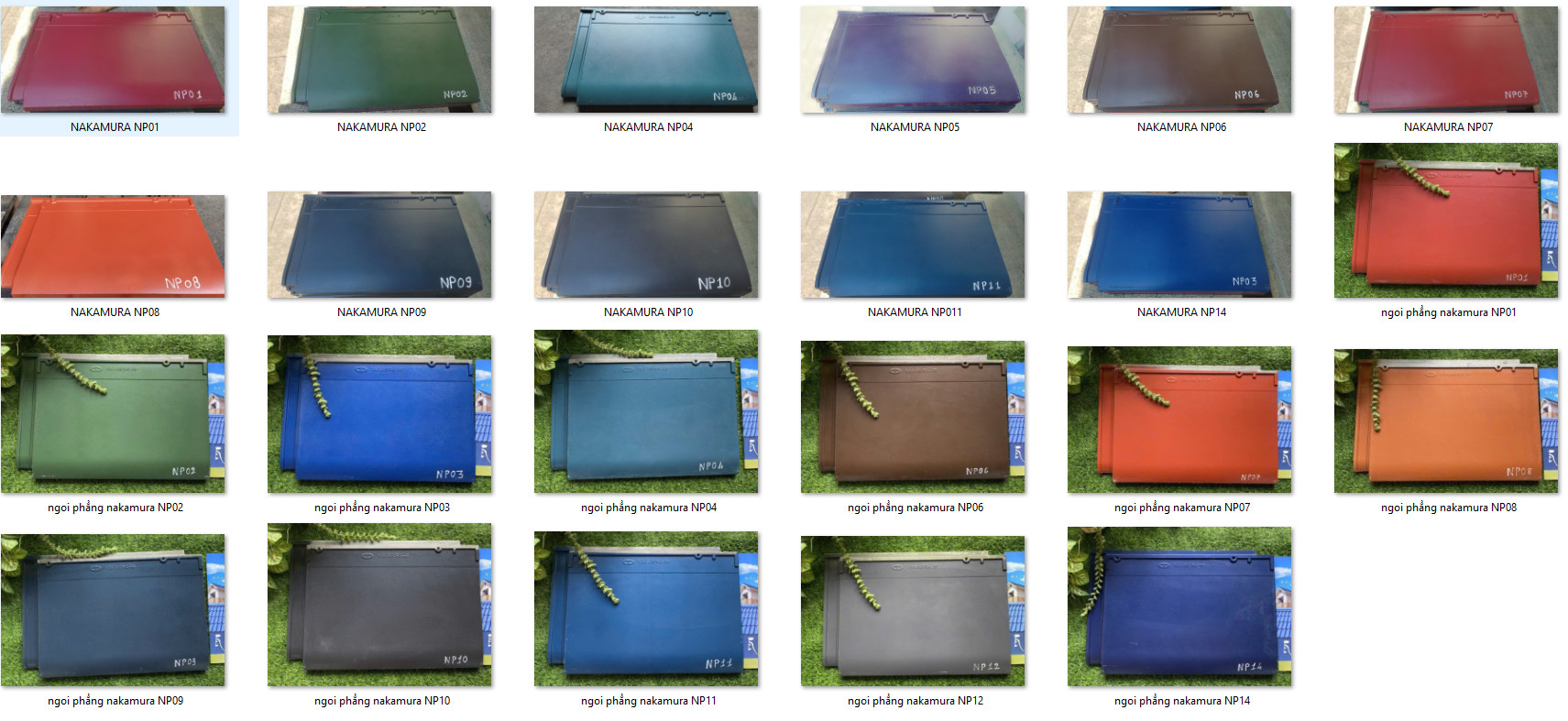

NGÓI NAKAMURA SÓNG NHỎ

NGÓI NAKAMURA SÓNG NHỎ NGÓI NAKAMURA SÓNG LỚN

NGÓI NAKAMURA SÓNG LỚN NGÓI PHẲNG NAKAMURA

NGÓI PHẲNG NAKAMURA