Three Steps to Mastering Prescriptive Profit Maximization

Our Intelligent Pricing Platform integrates your pricing, rebates and omnichannel pricing strategy into one system, executing your pricing across regions, verticals, or platforms. Let us streamline your pricing operations and empower your teams with the real-time data they need to make informed decisions today. While maximizing profits is extremely attractive to any business, businesses must balance this with ethical considerations and social responsibility. It’s important to note that your profit margin can vary depending on a number of factors, such as the competition in your category, the price of your product, and the cost of advertising. Therefore, it’s important to regularly review your profit margins to ensure that you’re maximizing your profits. Yours may be higher or lower depending on your industry and the products you sell.

That’s what makes the economic calculation of profit, by the way, differ from the accounting definition of profit. Profit maximization is finding the most efficient way to increase profits and improve the company’s overall financial health. In this article, we will explore the concept of profit maximization and its benefits, the formula used to calculate profit maximization and tips on how to implement it in your organization. Business people can maximize profit by following the above steps keeping time value of money, the risk and quality factor in consideration.

In equilibrium, marginal revenue equals marginal costs; there is no economic profit in equilibrium. Markets never reach equilibrium in the real world; they only tend toward a dynamically changing equilibrium. As in the example above, marginal revenue may increase because consumer demands have shifted and bid up the price of a good or service. By implementing the essential steps outlined in this article, businesses can increase their revenue, improve their bottom line, and achieve long-term financial success. From conducting market research and implementing value-based pricing to leveraging automation and AI, businesses have a wide range of strategies at their disposal. By prioritizing customer satisfaction, optimizing costs, and exploring growth opportunities, businesses can maximize their profits and secure a competitive edge in the marketplace.

.jpeg)

High-quality photos, engaging descriptions, and prompt responses to inquiries help their listings stand out in a crowded marketplace. Your business profit dictates for how much money you can sell your small business. Use asset protection strategies to protect your business’ worth and revenue. AI and machine learning tools can help you reshape your pricing strategies by offering dynamic pricing models that adapt swiftly to changing market conditions. A positive reputation encourages increased customer loyalty, better business partnerships, and overall success in the market. For instance, if you run a telehealth brand that specializes in DHT hair loss and skin care support for women, you might expand your products to target male shoppers as well.

AI software tools can streamline processes, reduce manual errors, and sometimes remove the necessity of an employee altogether. There are certainly learning curves to overcome but the benefits are worth it. If financing is the norm in your industry, suppliers may be open to a discount in exchange for cash upfront.

Regularly review your costs and see where you can make cuts without sacrificing quality. Because the more profit you make, the more you can grow your business. More money means you can possibly buy more properties, update your current ones, or even just have the peace of mind that comes with financial security. For your rental business, it could also mean reinvesting in marketing or improvements that enhance guest experiences, leading to even more bookings and, ultimately, more income.

But be aware not to make the https://trade-proair.net/ simple mistakes … aiming to increase sales, to increase profits. Increasing sales is widely seen as the key to increase profitability but this is a misconception. Sales are only one of a number of factors making up the profit formula. You need to understand how these factors work together to make informed decisions to improve your profitability. Time and again, sales figures, if increased in isolation, have failed to deliver increased profits.

It reveals how efficiently your company produces goods or services. All these calculations are part of a technique called marginal analysis, which breaks down inputs into measurable units. A lower marginal cost of production means that the business is operating with lower fixed costs at a particular production volume. If the marginal cost of production is high, then the cost of increasing production volume is also high and increasing production may not be in the business’s best interests. The target, in this case, is for marginal revenue to equal marginal cost.

Maintaining optimal inventory levels is crucial Maximize Your Profit for reducing storage fees and increasing your profit margins. Monitor your inventory levels regularly and adjust your stock levels based on demand and sales trends. This will help you avoid overstocking or understocking your products, which can lead to unnecessary fees and lost sales. Once you’ve determined that a price increase is the right move for your business, start small. Raising prices across the board can be jolting for your customers. Consider updating the prices of your top sellers first to maximize your profit margins right away and gauge customer reactions.

Securities and Advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.. Trivium Point Advisory and LPL Financial are separate entities. Tax and accounting related services offered through Trivium Point Advisory LLC, DBA Trivium Point Advisory, LLC. Trivium Point Advisory is a separate legal entity and not affiliated with LPL Financial.

Thirdly, try to increase the frequency with which every customer purchase from you. This is all about customer service and delivering on your promise. Keeping them happy Your goal should be to create customers for life. You are better off investing in your current customers and generating new business from them than you are trying to find new clients.

Remember, finding the best strategies for your business may take some trial and error, so don’t be afraid to experiment and adjust as needed. You can take your business to the next level with persistence and a commitment to excellence. One of the most effective ways to maximize profits is by focusing on customer retention. It is often more cost-effective to retain existing customers than to acquire new ones. This means providing exceptional customer service and building strong relationships with your customers. One way to do this is by creating a loyalty program that rewards repeat customers.

Adopting a profit maximization approach can be a good way to keep your operating cash flow healthy. Operating cash flow is the amount of cash that a business generates from its core operations, minus the cost of running those operations. It’s important for business owners to do everything they can to maximize their profits to increase their company’s chances of long-term survival. Total revenue and total costs for the raspberry farm are shown in Table 1 and also appear in Figure 1. By the way, notice that even if you owned the land, if you could have rented it to someone else, then that would be an opportunity cost. So your calculation of profit should also include opportunity costs.

It can also be the most costly if you don’t have the right marketing strategy. If all of your marketing, advertising and sales efforts are focused on price, then you will be beaten on price every time a competitor comes along with a lower one. In other words, if you focus on price as a critical factor, it will be one.

For example, companies may choose to earn less than the maximum profit in pursuit of higher market share. Because price increases maximize profits in the short term, they will attract more companies to enter the market. So we know the profit is total revenue minus total cost and both of these are functions of the quantity produced. You take the derivative of that function and you set it equal to zero. So in this case, we want to take the derivative of profit with respect to quantity and set that equal to zero. So derivative of profit with respect to quantity — that’s just the derivative of total revenue with respect to quantity minus the derivative of total cost with respect to quantity.

NGÓI NAKAMURA SÓNG NHỎ

NGÓI NAKAMURA SÓNG NHỎ NGÓI NAKAMURA SÓNG LỚN

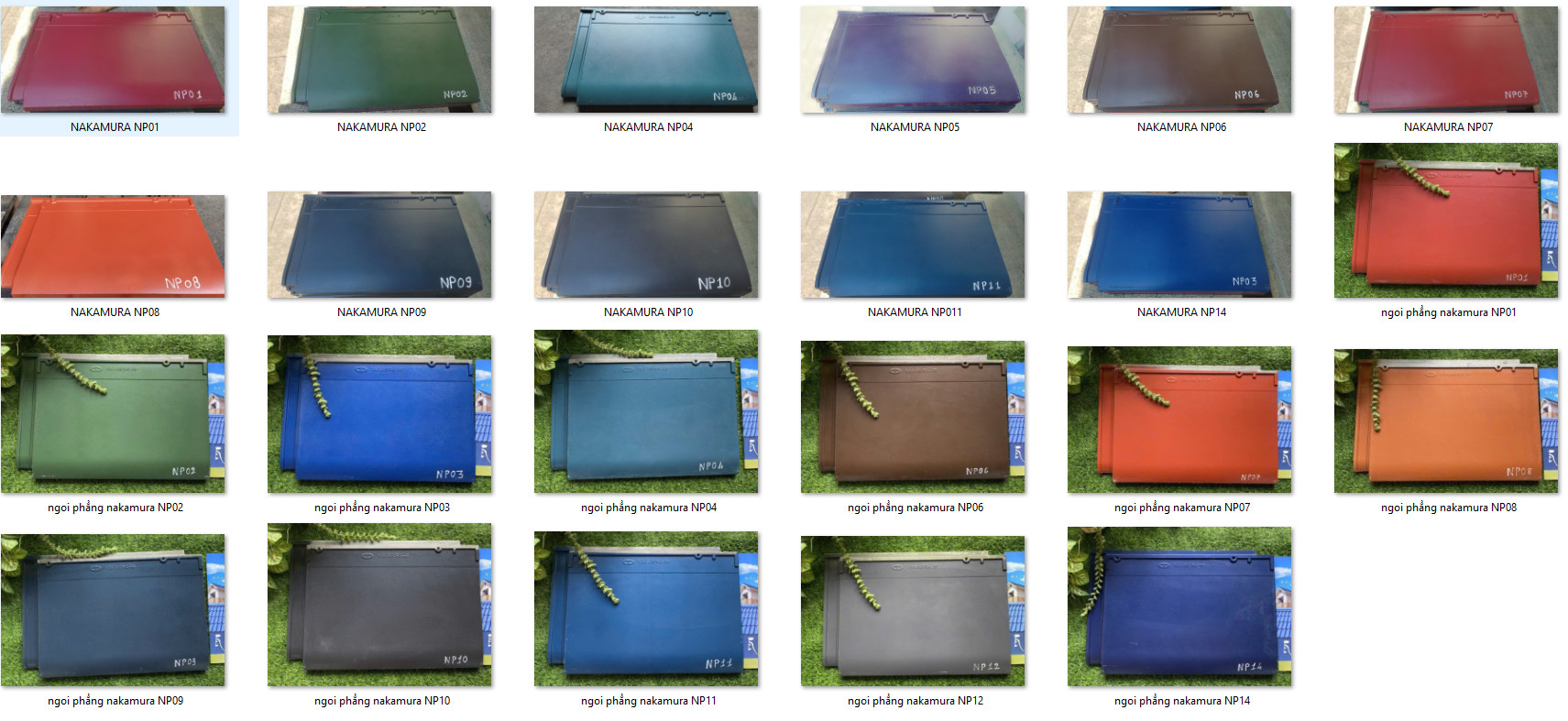

NGÓI NAKAMURA SÓNG LỚN NGÓI PHẲNG NAKAMURA

NGÓI PHẲNG NAKAMURA